by Athina Bardho

Luxury handbags like the iconic Birkin bag have long been symbols of status, elegance, and exclusivity. But in recent years, these high-end accessories have taken on a new identity — they’re no longer just about style, they’ve become serious investment assets. Whether you’re an affluent consumer or a savvy young investor, luxury handbags are now seen as an alternative asset class that offers high returns, making them an attractive addition to portfolios traditionally dominated by stocks and real estate. This analysis delves into the economic dynamics, cultural significance, and social trends fueling the rise of handbags as investment assets, exploring why these sought-after pieces are becoming a profitable choice for investors seeking alternatives to traditional markets.

Why Invest in Luxury Handbags?

Historically, the luxury handbag market wasn’t recognized for its financial returns. However, bags from brands such as Hermès, Chanel, and Louis Vuitton have demonstrated robust appreciation over time, occasionally outperforming traditional assets like gold or real estate. Here’s why luxury handbags are proving to be more than just stylish accessories:

Supply and Demand Economics

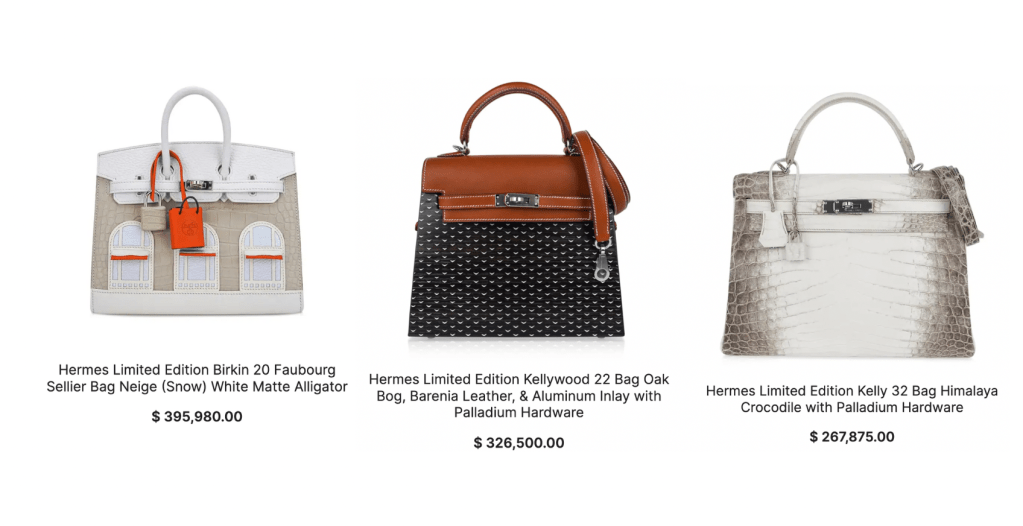

Luxury handbags, especially limited-edition models like the Hermès Birkin and Kelly bags, are produced in restricted quantities. Hermès, for instance, uses allocation-only sales, resulting in years-long waiting lists that increase both exclusivity and demand. According to Bloomberg, „Some Birkin models have appreciated 500% over the last 35 years,“ a testament to their scarcity’s impact on value (Karp, 2021).

Additionally, as the global economy grows and new wealth emerges, particularly in regions like Asia and the Middle East, the demand for luxury goods continues to rise. This influx of new consumers has contributed to increasing competition for limited editions, further driving up prices. The luxury handbag market is increasingly influenced by these economic dynamics, and the bags that capture consumer interest become coveted assets, which are often traded for substantial profit in the resale market.

https://mightychic.com/product-category/limited-edition/?orderby=price-desc

Cultural Cachet and Brand Heritage

The history and reputation of brands such as Hermès and Chanel elevate these bags to iconic status. Vintage and classic models hold particular allure due to their connection with famous personalities and cultural icons. The Birkin bag, famously named after actress Jane Birkin, has transcended fashion to become a symbol of luxury. High-profile endorsements by celebrities like Kylie Jenner and Victoria Beckham reinforce the desirability of these bags, making them not only a fashion statement but also a collector’s item (Pomerantz, 2021).

Social media has also played a significant role in enhancing the status of luxury handbags. Platforms like Instagram allow influencers and celebrities to showcase their collections, creating aspirational value that drives consumer interest. With high engagement levels on posts featuring luxury items, brands can leverage this visibility to fuel demand, resulting in price increases in both retail and resale markets.

Market Resilience

Luxury handbags have exhibited resilience, even during economic downturns. During the COVID-19 pandemic, when financial markets wavered, resale values for luxury bags remained buoyant. In markets like China and the Middle East, demand has been especially robust, highlighting these items‘ status as „safe-haven“ investments, even amidst global instability. According to The RealReal, „luxury handbags maintained steady resale values, even experiencing growth in select brands during economic hardships“ (The RealReal, 2020).

This resilience can be attributed to several factors, including the enduring appeal of luxury brands and the cultural importance placed on status symbols. Many consumers view luxury handbags as not just fashion items but as investments that hold intrinsic value, much like fine art or real estate.

Key Data: How Handbags Appreciate in Value

The appreciation rates for high-end bags would make many traditional investment portfolios envious. Hermès Birkin bags, for instance, have been known to appreciate around 14.2% annually, according to research published by the resale site Bags of Love (Bags of Love, 2023). Furthermore, the rapid growth of the luxury resale market, expected to reach $52 billion by 2026, emphasizes the financial potential of investing in high-end handbags (McKinsey, 2022).

Case Studies in Appreciation

Hermès Birkin Bag: A brand-new Birkin retails at around $10,000 to $150,000, depending on materials and craftsmanship. However, certain models, particularly limited-edition versions, can fetch up to $500,000 in the resale market. According to Sotheby’s, a record-breaking Birkin featuring diamond-encrusted details sold for $380,000 at auction (Sotheby’s, 2023). The Birkin’s exclusivity, combined with its timeless design, has made it a favored investment among the affluent.

Louis Vuitton Pochette Accessoires: Originally released in 1992 for $165, the Pochette Accessoires has appreciated by over 300%. The bag’s sustained appeal among style icons and its frequent association with high-profile collaborations have kept it desirable. Items from Louis Vuitton’s collaborations with artists like Takashi Murakami have also seen significant appreciation, reflecting how brand collaborations can influence market value (Karp, 2021).

Chanel Classic Flap Bag: The Classic Flap, a staple in many wardrobes, has experienced a 20% increase in price over the last year alone, according to Fashionista. Originally retailing at $2,800, it now often commands prices above $6,000 in the resale market (Wang, 2023). Chanel’s consistent price hikes, coupled with the bag’s enduring popularity, contribute to its investment potential.

Strategic Considerations for Investors

Investing in luxury handbags is no casual endeavor. Understanding brand reputation, craftsmanship, and market trends is essential. Here are some vital aspects to consider:

- Brand and Craftsmanship

Investors often gravitate toward brands like Hermès, Chanel, and Louis Vuitton, as these brands uphold stringent standards in materials and craftsmanship. The Chanel Flap Bag, for example, appreciates in value partly due to the craftsmanship involved in creating each piece, which remains consistent with the brand’s legacy (Luxury London, 2023).

Moreover, the materials used significantly impact a bag’s longevity and desirability. Exotic leathers, such as crocodile and ostrich, not only add to the aesthetics but also to the investment potential. For example, a crocodile Birkin can fetch more than double the price of a standard leather version due to its rarity and the craftsmanship involved in its creation.

2. Condition

Like any collectible item, luxury handbags retain the highest value when in pristine condition. Proper storage (ideally in a climate-controlled environment) and careful handling are paramount for preserving an investment piece. A Chanel bag in mint condition can appreciate by up to 10% more than a gently used one. The right storage solutions, including dust bags and boxes, can help protect the bag from wear and tear.

Provenance and Authenticity

Counterfeiting remains a persistent issue within the luxury market. As such, collectors and investors must ensure the authenticity of their pieces, often through professional authentication services or auction houses like Christie’s or Sotheby’s. According to Forbes, “Provenance has become paramount in maintaining and maximizing handbag value” (Forbes, 2024). This emphasis on authenticity means buyers should consider obtaining receipts, documentation, or even certificates of authenticity when purchasing high-value bags.

Limited Editions and Unique Features

Limited-edition bags, unique colorways, or collaborations can command higher resale values. For example, Chanel’s collaboration with Pharrell Williams in 2019 introduced a line of bags with exclusive designs, resulting in high resale values post-launch. This trend has implications for investors, suggesting that monitoring brand announcements and fashion week reveals could yield insights into future investment opportunities.

Resale Market Trends and Growth

The luxury handbag resale market has evolved significantly, bolstered by platforms like The RealReal, Vestiaire Collective, and Rebag, which make buying and selling high-end bags accessible to a global audience. This trend has resonated particularly with younger consumers who value sustainability and circular fashion principles.

The Circular Fashion Movement

Eco-conscious Gen Z and millennial buyers have propelled the resale market’s growth, viewing pre-owned luxury as both a socially responsible choice and an accessible entry point into high-end fashion. According to McKinsey, “Gen Z consumers prioritize sustainability, with 41% stating they prefer buying pre-owned luxury items over new ones” (McKinsey, 2022). This shift has prompted brands to reconsider their production strategies, with many embracing sustainable practices to meet consumer expectations.

Social Media Influence

Platforms like Instagram and TikTok have amplified luxury handbag visibility. Social media influencers showcasing their designer bags have increased demand among younger consumers, fostering a community that values bags as both a personal statement and an investment. The hashtag #InvestmentBag has garnered millions of views on social media platforms, indicating a growing awareness and interest in luxury handbags as investment pieces.

Comparing Bags to Traditional Investments

How do high-end bags compare to traditional investments like stocks or real estate?

Long-Term Appreciation

Luxury handbags, particularly Hermès bags, have demonstrated consistent appreciation, often with lower volatility than stocks. Between 2020 and 2021 alone, the Hermès Birkin’s value surged by 41% (Mason, 2021). While stocks may offer liquidity, they are also susceptible to market fluctuations, whereas a carefully selected handbag can offer more stable returns.

Additionally, research from the Luxury Investment Index indicates that luxury handbags have outperformed many traditional asset classes over the past decade. The index shows that luxury handbags appreciated by an average of 25% per year, surpassing gold (around 10%) and the stock market (averaging around 7% annually) (Bain & Company, 2023). Portability and Tangibility

Unlike stocks or bonds, luxury handbags are tangible assets that can be enjoyed and used. Owners can appreciate their investment daily while retaining the ability to sell or trade the item in the future. This combination of enjoyment and investment makes luxury handbags a unique asset class, particularly appealing in a consumer-driven society that values both luxury and practicality.

Economic Factors

The performance of luxury handbags as investments is closely tied to economic conditions. During economic downturns, luxury goods tend to see a dip in demand; however, the high-end market often rebounds faster than more affordable goods. For instance, during the 2008 financial crisis, the luxury goods sector saw a temporary decline, but it quickly regained strength, with luxury handbag sales hitting record highs within a few years (Deloitte, 2023).

This resilience reflects the notion that wealthier consumers are less affected by economic fluctuations, allowing them to continue purchasing luxury items, thus sustaining demand and, consequently, prices in the resale market.

Risks to Consider

Investing in luxury handbags, while potentially lucrative, is not without its risks. Market trends can shift, and what is desirable today may not hold the same value in the future. Additionally, the authenticity of luxury items can be a significant concern, with counterfeit bags becoming more sophisticated. Investors must conduct thorough research and possibly seek expert advice before making substantial purchases.

Furthermore, as the luxury market evolves, shifting consumer preferences could affect the desirability of specific brands or styles. Keeping abreast of market trends, fashion week insights, and influencer endorsements is vital for savvy investors to mitigate these risks.

Conclusion

Luxury handbags have emerged as a viable alternative investment, challenging traditional asset classes with their unique combination of cultural significance, limited availability, and economic resilience. The allure of bags like the Hermès Birkin transcends fashion, making them sought-after items in the investment landscape. With careful selection and strategic market analysis, investing in luxury handbags can yield impressive returns, marking a new frontier for both seasoned investors and fashion enthusiasts alike.

In a world increasingly fascinated by the intersection of fashion and finance, luxury handbags offer not only a statement of style but also a sound investment strategy, inviting individuals to embrace the elegance of owning a piece of luxury history while potentially reaping financial rewards.

References

Bain & Company. (2023). Global Luxury Report 2023. https://www.bain.com/globalassets/noindex/2023/global-luxury-report-2023.pdf

Bags of Love. (2023). Luxury Handbags as an Investment: The Best Brands for Your Money. https://www.bagsoflove.com/luxury-handbags-investment

Deloitte. (2023). Global Powers of Luxury Goods 2023. https://www2.deloitte.com/global/en/pages/consumer-business/articles/global-powers-of-luxury-goods.html

Karp, J. (2021). The secret world of luxury handbags: Why the Birkin is still the ultimate status symbol. Bloomberg. https://www.bloomberg.com/news/articles/2021-10-08/the-secret-world-of-luxury-handbags-why-the-birkin-is-still-the-ultimate-status-symbol

Luxury London. (2023). Why luxury handbags are a good investment. https://luxurylondon.co.uk/style/why-luxury-handbags-are-a-good-investment

Mason, M. (2021). The true value of a Birkin bag. Forbes. https://www.forbes.com/sites/michellemason/2021/06/15/the-true-value-of-a-birkin-bag/?sh=3f3c50065c60

McKinsey & Company. (2022). The State of Fashion 2022. https://www.mckinsey.com/industries/retail/our-insights/the-state-of-fashion-2022

Pomerantz, S. (2021). The enduring legacy of the Hermès Birkin bag. Fashionista. https://fashionista.com/2021/11/hermes-birkin-bag-history-legacy

Sotheby’s. (2023). Record-setting Birkin bags: The auction highlights of 2023. https://www.sothebys.com/en/articles/record-setting-birkin-bags-the-auction-highlights-of-2023

The RealReal. (2020). Luxury resale market trends. https://www.therealreal.com/luxury-resale-market-trends

Wang, A. (2023). Chanel bag prices soar as resale value climbs. Fashionista. https://fashionista.com/2023/02/chanel-bag-prices-resale-value

Hinterlasse einen Kommentar